5186205183: Investing in Startups – Risks & Rewards

Investing in startups involves navigating a complex environment characterized by high potential returns and significant risks. Investors must conduct thorough evaluations of business models and market dynamics to make informed decisions. Understanding the specific risks associated with startup investments is crucial. However, the pursuit of lucrative opportunities requires more than just awareness of these factors. What strategies can investors employ to enhance their chances of success in this volatile landscape?

Understanding the Startup Landscape

A significant portion of the investment landscape is dominated by startups, which represent a dynamic and rapidly evolving sector.

Understanding market trends is crucial, as they indicate shifts in consumer behavior and industry demands.

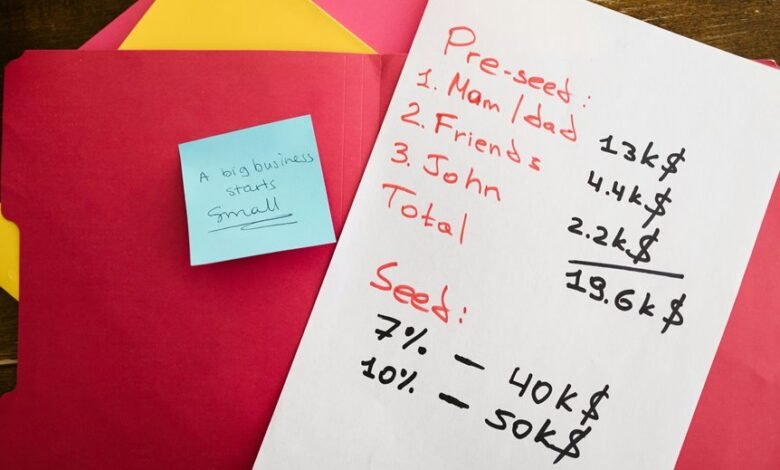

Additionally, diverse funding sources, ranging from venture capital to crowdfunding, play a pivotal role in enabling startups to innovate and scale, thereby influencing their potential for growth and sustainability.

Evaluating Risks in Startup Investments

How can investors effectively navigate the myriad risks associated with startup investments?

Conducting thorough due diligence is crucial, as it enables investors to assess potential market volatility and the startup's business model.

Understanding financial health, competitive landscape, and team dynamics can mitigate risks.

Strategies for Maximizing Rewards

Navigating the complexities of startup investments requires not only an understanding of risks but also the implementation of strategies that can maximize potential rewards.

Employing diversification tactics across various sectors can mitigate losses, while well-defined exit strategies ensure that investors capitalize on successful ventures.

Conclusion

In the intricate tapestry of startup investing, each thread represents potential risks and rewards woven together by innovation and market dynamics. Investors must navigate this labyrinth with diligence, skillfully balancing their portfolios while remaining attuned to evolving trends. By engaging with seasoned experts and maintaining an active stance in monitoring their investments, they can transform the volatility of startup landscapes into opportunities for substantial returns, ultimately crafting a narrative of success amidst uncertainty.