Financial Growth With Bookkeeping Resonanceenter1

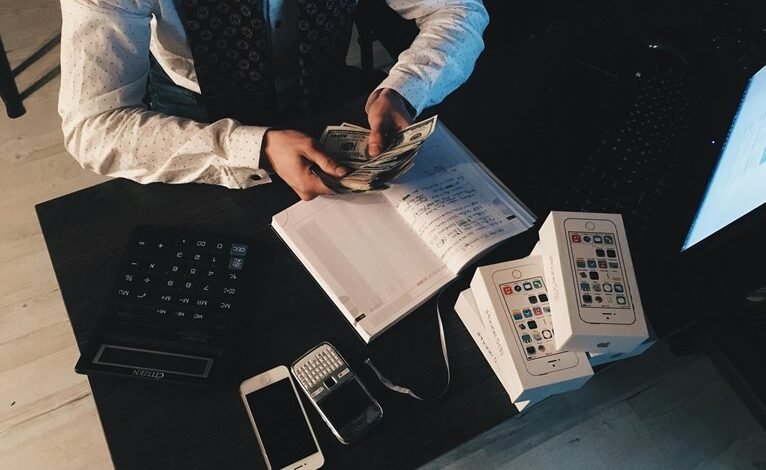

Financial growth increasingly hinges on effective bookkeeping practices, particularly through methodologies like Resonanceenter1. This approach emphasizes systematic transaction tracking and precise data management, which can significantly reduce human error. By fostering a clearer understanding of financial metrics, businesses can enhance decision-making and resource allocation. However, the implementation of such practices raises questions about scalability and adaptability in diverse business environments. What are the key strategies for successful integration?

Understanding Bookkeeping Resonanceenter1

Although many business owners may view bookkeeping as a mundane task, understanding its fundamental principles is essential for fostering financial growth.

Bookkeeping fundamentals establish a framework for recording transactions, ensuring financial accuracy, and monitoring cash flow.

Benefits of Effective Bookkeeping Practices

Effective bookkeeping practices offer numerous advantages that significantly enhance a business's operational efficiency and financial health.

By meticulously tracking expenses and revenues, companies can achieve substantial cost savings. Additionally, accurate records facilitate tax compliance, reducing the risk of penalties and audits.

This foundational aspect of financial management empowers businesses to make informed decisions, ultimately fostering sustainable growth and increased profitability.

Implementing Bookkeeping Resonanceenter1 in Your Business

Implementing Bookkeeping Resonanceenter1 in a business can significantly streamline financial processes and improve overall management efficiency.

This system facilitates automated tracking of transactions, ensuring accurate data collection and analysis. By optimizing workflows and reducing manual errors, businesses can achieve substantial cost reduction.

Ultimately, the adoption of this bookkeeping approach empowers companies to allocate resources more effectively, enhancing their operational freedom and financial growth potential.

Measuring Financial Growth Through Bookkeeping Insights

While many businesses focus on revenue growth as the primary indicator of financial success, measuring financial growth through bookkeeping insights provides a more comprehensive understanding of overall performance.

Analyzing financial metrics such as profit margins, cash flow, and expense ratios serves as vital growth indicators. This approach enables organizations to identify strengths and weaknesses, fostering informed decision-making and sustainable financial strategies.

Conclusion

In conclusion, bookkeeping Resonanceenter1 serves as a cornerstone for cultivating comprehensive financial clarity. By prioritizing precision and proactive practices, businesses can not only streamline their operations but also stimulate sustainable success. The systematic strategies employed within this framework empower organizations to harness insightful data, driving informed decisions that ultimately lead to enhanced profitability. Thus, embracing effective bookkeeping practices paves the path for perpetual progress and prosperity in the ever-evolving financial landscape.